The New York Times, and others, report that a new report from the Commodities Future Trading Commission (CFTC) released Sept. 9 concludes that climate change threatens the financial system in the U.S. The report was commissioned by the CFTC and written by dozens of analysts from investment firms, oil companies, an agricultural business, academic experts and environmental groups. All five members of the CFTC were appointed by President Trump.

The reports conclusion is dire: “A world wracked by frequent and devastating shocks from climate change cannot sustain the fundamental conditions supporting our financial system.”

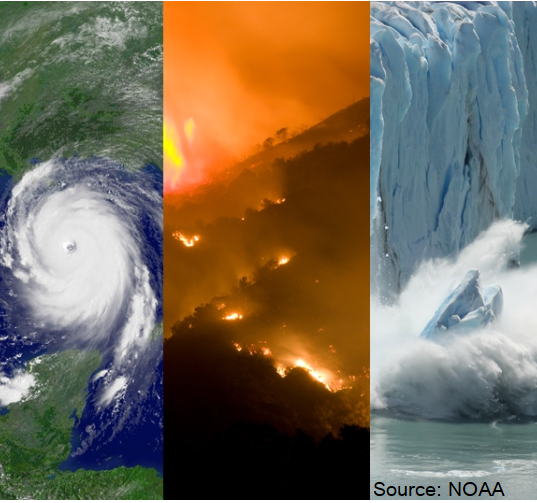

Some of the risks the report found include insurance companies pulling out of California because of wildfire risks, diminished home values in coastal areas and floodplains, banks limiting loans after droughts in the Midwest, and much more. Extreme weather could cause wild swings in agricultural commodity prices, and market volatility could affect pension and retirement funds.

The report is a policy roadmap to help the country address climate change and all the risks that climate change brings.

Robert Litterman, founder of an investment firm and chair of the panel that wrote the report said: ” “This is members of the entire community involved in financial markets saying with one voice, ‘This is a serious problem, and it has to be addressed.’”

It is clear that climate change is happening, it is harming our health and wellbeing now, and it is affecting the the financial system too. This is why we need a green just recovery package for the virus, and other policies to address climate change, now.